News

Inflation risk: how it could reduce your wealth and how investing could protect your money

According to a recent article in the Independent, retail sales in May “soared” as further easing of lockdown restrictions led to increased spending. The report reveals that retail sales increased by 10% in May 2021, against the same period in 2019.

It’s fair to say that increased spending is a much needed shot in the arm for the economy, but some media reports suggest it may only be the tip of the iceberg.

The Guardian, for example, points out UK households have saved £192 billion since the start of lockdown in March 2020, adding that 26% of that amount could be spent when Covid rules are lifted.

Small surprise then that the Bank of England’s chief economist, Andy Haldane, told the Daily Mail that Britain’s economic recovery could put us ahead of other nations.

But the confidence of a strong economic recovery has also resulted in talk of rising inflation, which could devalue your wealth in real terms. Read on to discover what inflation is, what higher inflation could mean for your wealth, and what you may be able to do to mitigate its impact on your money.

1. Inflation is the increasing cost of the goods and services we buy

Put simply, inflation is the rate at which the price of goods and services increases, and it impacts on everything from mortgages to the cost of your weekly shop.

While a small amount of inflation is seen as good thing as it shows we have a healthy economy, if it rises and your money’s growth is not keeping pace, then your wealth will lose value in real terms.

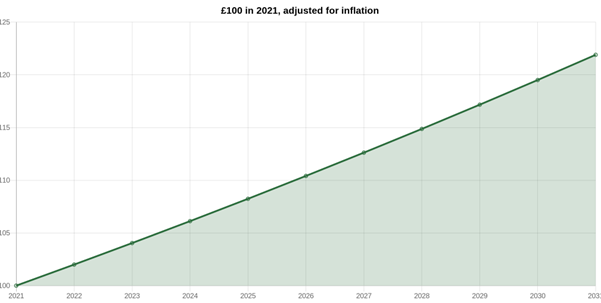

To illustrate this, the following graph shows that an average inflation rate of 2% over the next 10 years would mean you’d need £121.90 in 2031 to have the same spending power as £100 today. In other words, your money will need to grow by more than 20% just to hold its value.

Source: CPI Inflation Calculator

2. Historically low interest rates mean your money could reduce in value

Data from the Office for National Statistics shows UK inflation reached 2.1% in May, up from 1.5% in April 2021 and 0.7% the month before. This was driven by increased oil prices, higher energy bills and an increased demand for clothing as retailers re-open as lockdown eased.

A recent Guardian article reveals the average interest rate for an easy access account was 0.16%, nearly 2% lower than the rate of inflation. This means money in savings accounts could be reducing by up to this amount in real terms.

While interest rates have historically tended to rise with inflation, it’s important to remember that the Covid pandemic means we are living in unusual times. Key to this is the amount of money the government has borrowed to shore up Britain’s finances through the lockdown.

Official figures show that Britain has borrowed £303 billion during the pandemic, the largest amount ever borrowed in peacetime. This means that if the Bank of England (BoE) were to increase interest rates, the amount the government would need to pay to service the debt will rise – in the same way a variable interest rate mortgage would increase with an interest rate rise.

With this in mind, the BoE may delay increasing interest rates even if inflation continues to rise, in a bid to help the government and the economy.

3. Investments could help inflation-proof your savings

One way you could help protect your money against inflation is to invest it. Typically, over the long term, investment growth is greater than inflation, helping your money maintain its value.

The 2019 Barclays Equity Gilt Study, which tracked the nominal performance of £100 invested in cash and other investments between 1899 and 2019, reveals that £100 invested in cash in 1899 would be worth just over £20,000 in 2019. If you had put the money into stocks and shares, it would have been worth around £2.7 million.

Putting your money into a Stocks and Shares ISA can expose your money to potential growth levels that could inflation-proof it, and any growth or income you take from it will be tax free. You can also contribute up to £20,000 into ISAs during the 2021/22 tax year, providing the potential to build a sizable tax-efficient lump sum relatively quickly.

Another way to expose your money to greater long-term growth could be to invest in pensions. As this attracts tax relief on your contributions up to your Annual Allowance, this can help boost any potential growth.

You should remember that putting money into a pension typically locks it away until you are aged 55 (rising to 57 in 2028), and Annual Allowances can differ depending on your income. The latter is something we’d be happy to help you confirm.

If you have used up your ISA allowance and do not feel a pension is suitable for you, another alternative could be to invest your money elsewhere. As there may be tax implications it’s important to speak with us to confirm what would be appropriate for you, and the potential risks and rewards involved.

Get in touch

If you would like to discuss the risk of inflation on your wealth and how you may be able to mitigate it, please contact us on 0800 434 6337.

Please note:

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and your financial circumstances.

Have My Cake And Eat It

A change in lifestyle